Prototype Computer Center Facility for the Internal Revenue Services

- Subject:

- Building

- Project Number:

- 0676

- Date:

- 1981

- Client:

- US Government General Services Administration

- Location:

- Covington, Kentucky

- Project Name:

- Prototype Computer Center Facility for the Internal Revenue Services

In 1976, Beverly Willis and Associates, Inc. (Willis) was awarded a federal building commission from the General Services Administration (GSA) in Washington, DC, representing the Internal Revenue Service (IRS), and administered by the GSA office in Kansas City, Missouri. The project was planned by the IRS as a prototype design that would be site-adapted to nine IRS regional locations in the United States, as part of an $800 million program.

While the prototype facility’s planned location was in the Covington, Kentucky, IRS region, the architect search committee looked nationally to find an architectural firm. The selection criteria focused on technical ability and computer proficiency. Willis’s firm was selected because of their technical achievements in the development of a proprietary Computerized Approach to Residential Land Analysis, referred to as CARLA. Willis’s experience with the development of CARLA provided her and her firm with the technical knowledge and expertise the IRS required for its Computer Center Building. John Casey, the client representative for the GSA, explained that “we were looking to hire a firm that had the best technical qualifications” and chose Willis and her associates “based on their technical abilities and approach to this project.”

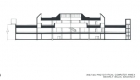

The Computer Center Building prototype was part of a larger, billion-dollar program to automate tax returns on the nine tax-processing campuses of the IRS. At that point, the agency had already developed a layout for the functionality of the structure−“on the way it would work inside, how the tax forms would be processed, and how submissions by taxpayers would be delivered.” The building design needed to accommodate the IRS’s newly developed mainframe computers and allow for future expansion from one to four stories. The design objective was ultimately to create a four-story design that would break the architectural monotony of its mega-sized campuses of slab-like, rectangular, single-story buildings.

Willis designed a geometric, octagonal form that could be rotated 360 degrees on site. Its angular sides provided a wall for a corridor link that could mesh with an existing “mother” building through an umbilical cord–like, glass-enclosed passageway. Visitors and staff would approach the building entrance from the sidewalk, coming into the lobby at the point where the two buildings joined: the new entry would provide access to both buildings. This approach permitted the buildings to be configured and adapted to the existing conditions on other campuses. The exterior walls were designed so that they could be clad with any type of material. This meant that the exterior material could match the design context of the IRS campus on which it was placed.

The use of a steel structural system permitted the reconfiguration of the exterior and interior walls, as well as the ceiling. To meet the program’s extreme flexibility requirements, overhead lighting and wall outlets (except in selected exit areas) as well as ducts and pipes had to be eliminated from the walls and ceilings. To obviate the use of the wall cavities and ceilings for mechanical and electrical services, Willis developed a raised floor concept that accommodated building infrastructure (electrical wiring, pipes, ducts). This design innovation necessitated raising the floors approximately twelve inches above the structural floor slab to provide adequate space for the infrastructure. An added advantage of the raised floor was that its removable panels provided easy access to—and relocation of—mechanical and electrical systems, for instance when workstations changed locations. This prototype design by Willis was a concept that would become a GSA standard, used throughout the construction industry.

Within the octagonal-shaped building plan, offices were located along the outside perimeter, with the mainframe computer equipment placed on the inside. An open-air courtyard occupied the center of the building. As the building “grew up” to more stories, the courtyard would remain, becoming a domed atrium. The basement below provided delivery-truck access for computer supplies and tax returns, as well as storage and filing space. In place of overhead lighting, bollard lighting was introduced to reflect light into the room by shining it on the ceiling and walls. Task lighting and all the computer workstations’ electrical connections were tied through the workstation frame to wiring under the floor.

The nearly billion-dollar building program set forth by the IRS and administered by the GSA was, in the end, never built. President Jimmy Carter vetoed the funding for the project, making headline news. The project’s considerably high budget, however, was not the cause of the veto. As John Casey explains, “the main factor was a Big-Brother aspect; […] back then, the thought of having all this data on all of our 200-million-plus residents of the United States, all on single data bank entries, that people might abuse or [that might] get corrupted or stolen was just an insurmountable task to get through Congress.” Indeed, this period is marked by increasing concern over lack of security safeguards in government operations, the world’s largest user of computers at that time. Auditors frequently reported computer-related crimes, including fraudulent records and destruction of information files. As a result, the Carter administration moved to “tighten security over the Federal Government’s far-flung network of computers to protect individual privacy and to prevent fraud and misuse.” As reported by The New York Times, the directive included specific measures for “the General Services Administration to set regulations for physical security of computer rooms.” This forced the IRS to used other methods to computerize the nation’s tax returns––at greater expense to the government, with less security.